Introduction In the ever-evolving world of taxation and finance, understanding the nuances of arrears relief […]

Category: Income Tax Challan ITNS 280 in Excel

- Income Tax

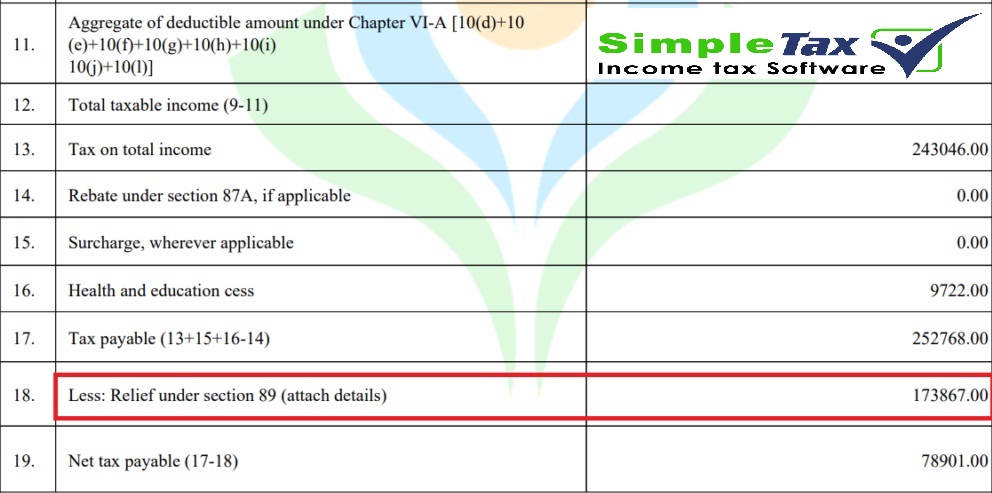

- Income Tax Arrears Relief Calculator U/s 89(1)

- Income Tax Automated Form 16

- Income Tax Automated Form 16 Part B

- Income Tax Calculator

- Income Tax Challan ITNS 280 in Excel

- Income Tax Exemption from Bank Savings Interest U/s 80TTA

- Income Tax for the West Bengal Govt employees

- Income Tax Form 10E

Income Tax Preparation Software All in One in Excel for Govt and Non-Govt Employees for FY 2023-24

Income tax preparation can be a daunting task, but with the right tools, it can […]

- Automated House Rent Exemption Calculator U/s 10(13A) in Excel

- Income Tax

- Income Tax Arrears Relief Calculator U/s 89(1)

- Income Tax Automated Form 16

- Income Tax Automated Form 16 Part B

- Income Tax Calculator

- Income Tax Challan ITNS 280 in Excel

- Income Tax Exemption from Bank Savings Interest U/s 80TTA

- Income Tax for the West Bengal Govt employees

- Income Tax Form 10E

Benefits of New Tax Regime 2023 with All-in-One Automated Income Tax Preparation Software for Government and Non-Government Employees for FY 2023-24

Introduction Benefits of New Tax Regime 2023| The dawn of the fiscal year 2023 has […]

Download Auto Calculate Income Tax Prep- Software All in One in Excel for the West Bengal Govt Employees for FY2023-24.

Are you a West Bengal government employee looking to streamline your income tax preparation for […]

- Arrears Relief Calculator U/s 89(1)

- Income Tax

- Income Tax Arrears Relief Calculator U/s 89(1)

- Income Tax Automated Form 16

- Income Tax Automated Form 16 Part B

- Income Tax Calculator

- Income Tax Challan ITNS 280 in Excel

- Income Tax Exemption from Bank Savings Interest U/s 80TTA

- Income Tax for the West Bengal Govt employees

Download and Prep: Auto Calculate Tax in Excel All in One for Govt & Non-Govt Employees for F.Y. 2023-24

1. Introduction Preparing your taxes can be a daunting task, but it’s a necessary one. […]

- Arrears Relief Calculator U/s 89(1)

- Income Tax

- Income Tax Arrears Relief Calculator U/s 89(1)

- Income Tax Automated Form 16

- Income Tax Automated Form 16 Part B

- Income Tax Calculator

- Income Tax Challan ITNS 280 in Excel

- Income Tax Exemption from Bank Savings Interest U/s 80TTA

- Income Tax for the West Bengal Govt employees

- Income Tax Form 10E

- Income Tax HRA Exemption Calculator U/s 10(13A)

- Income Tax Rebate U/s 87A

Auto Calculate Tax Calculator for the Govt and Non-Govt Employees for the F.Y. 2023-24

In the contemporary, rapidly moving world, effectively managing your finances is absolutely crucial. For both […]

How Attractive the New Tax Regime for FY 2023-24 with Auto Calculate Income Tax Preparation Software in Excel All in one for the Government and Non-Government Employees for F.Y.2023-24

The world of taxes is constantly evolving, and staying on top of the latest changes […]

- Arrears Relief Calculator U/s 89(1)

- Automated House Rent Exemption Calculator U/s 10(13A) in Excel

- Income Tax

- Income Tax Arrears Relief Calculator U/s 89(1)

- Income Tax Automated Form 16

- Income Tax Automated Form 16 Part B

- Income Tax Calculator

- Income Tax Challan ITNS 280 in Excel

- Income Tax Exemption from Bank Savings Interest U/s 80TTA

- Income Tax Form 10E

- Income Tax Rebate U/s 87A

- Income Tax Section 24B

Is Sec 87A Tax Rebate Rs.50,000/- Available in both Tax Regimes? With Auto Calculate Income Tax Preparation Software All in One for the Government and Non-Government Employees for the F.Y.2023-24 as per Budget 2023

Is Sec 87A Tax Rebate Rs.50,000/- Available in both Tax Regimes? With Auto Calculate Income […]

- Arrears Relief Calculator U/s 89(1)

- Automated House Rent Exemption Calculator U/s 10(13A) in Excel

- Income Tax

- Income Tax Arrears Relief Calculator U/s 89(1)

- Income Tax Automated Form 16

- Income Tax Automated Form 16 Part B

- Income Tax Calculator

- Income Tax Challan ITNS 280 in Excel

- Income Tax Exemption from Bank Savings Interest U/s 80TTA

- Income Tax for the West Bengal Govt employees

- Income Tax Form 10E

- Income Tax Rebate U/s 87A

Easy Tax Saving Tips with Automatic Income Tax Preparation Software All in One in Excel for the Non-Govt Employees for F.Y.2023-24

Introduction In today’s busy world, it’s important to manage your money well. One big part […]

- Automated House Rent Exemption Calculator U/s 10(13A) in Excel

- Income Tax

- Income Tax Arrears Relief Calculator U/s 89(1)

- Income Tax Automated Form 16

- Income Tax Automated Form 16 Part B

- Income Tax Calculator

- Income Tax Challan ITNS 280 in Excel

- Income Tax Exemption from Bank Savings Interest U/s 80TTA

- Income Tax for the West Bengal Govt employees

- Income Tax Form 10E

- Income Tax Rebate U/s 87A

- Income Tax Section 24B

Income Tax Section 80U-With Auto Tax Preparation Software All in One in Excel for Govt & Non-Govt Employees for FY2023-24

In a world filled with uncertainties, having the safety net of health insurance is crucial. […]