The five most important sections of income tax| Anyone who earns income in the state is responsible

for paying income tax. The Income Tax Law consists of different articles that deal separately with

various aspects of taxation in the country. In addition, this law also provides taxpayers with several

income tax deductions that they can claim when filing their Income Tax Returns (ITR). Once the

deductions have been made, the tax will be charged on the total tax base according to the rates of the

taxpayer’s income tax bracket.

Income Tax Act has 23 chapters in total and 298 sections, according to the official website of the Department of Income Tax. Although it is very tedious to review all the sections and chapters of the income tax, the Income Tax Administration encourages taxpayers to take advantage of the deductions and rebates provided for in the Income Tax Law, to reduce the amount subject to tax.

However, there are five sections in particular that every taxpayer should know, which will be especially useful when he decides to invest his group in one of the investment vehicles.

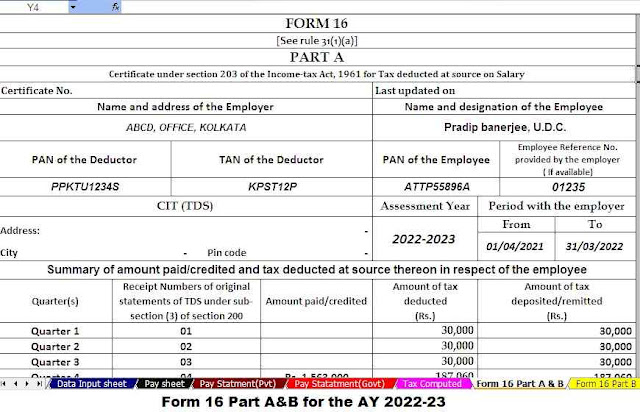

Download and Prepare at a time 50 Employees Form 16 Part B for the Financial Year 2021-22

Section 80C – Tax deduction on investments

Section 80C of the Income Tax Act allows deductions for investments made in certain instruments. Two of the most popular are tax-saving mutual funds and tax-saving fixed deposits. Tax-saving mutual funds are equity-oriented; This means that at least 65% of its entities must invest in inequality.

The Equity Linked Savings Scheme (ELSS) comes with a 3-year lock-in period of a minimum of 80% of the group invested in the shares and is eligible for tax deductions of up to Rs. 1.5 lakhs under Section 80C of the Income Tax Act.

Similarly, a tax-saving fixed deposit system has a maturity of at least 5 years, with a maximum deduction of Rs. 1.5 lakhs an investor can claim. Tax on interest earned in excess of 10% will be based on the rates in the personal income tax bracket.

You can invest in time deposits with returns of up to 8.35% at Finserv Markets (with an additional 0.25% above current senior rates). You can choose between flexible tenures ranging from 12 months to 5 years and benefit from guaranteed returns.

Deduction 80CCC – Tax Deduction for Contribution to Pension Funds

As a result of an attempt to encourage taxpayers to begin investing in pension funds, Section 80CCC provides an income tax deduction for Chapter VI-A pension funds from the taxpayer’s gross gross income for that tax year. . This provides a tax deduction for any amount paid or deposited in the annual premium plan of any insurance company (LIC or other). Also, the maximum deduction that can be claimed through Section 80CCC is Rs. 1.5 lakhs.

Download and Prepare at a time 50 Employees Form 16 Part A&B for the Financial Year 2021-22

Section 80CCD – Tax Deduction for Contribution to the National Pension Scheme

Section 80CCD establishes income tax deductions for contributions to the National Pension System (NPS). Also, the maximum deduction that can be claimed from Section 80CCD (1) is 10% in the case of a salaried person (employee) from non-employees (self-employed).

Section 80CCD (1B) entitled to get an additional deduction of up to Rupees Fifty Thousand for the group deposited by the individual into their NPS account.

Section 80CCD(2) allows individuals to claim an additional deduction on their contribution to an employee’s pension account of up to 10% of their salary.

Section 80TTA – Tax exemption for interest on a savings account

Under Section 80TTA of the Income Tax Act (Chapter VI-A), individuals can claim an exemption of up to Rs. 10,000 per year of interest earned on deposits in savings accounts held in banks, post offices or cooperatives.

Section 80TTB – Interest Income Tax Exemption for Seniors Citizen above 60 Years Age.

According to the 80 TTB section of the Income Tax Law, seniors (age 60 and over) can claim tax credits on the interest income from deposits they hold. The maximum allowable deduction in a financial year is Rs. 50000.

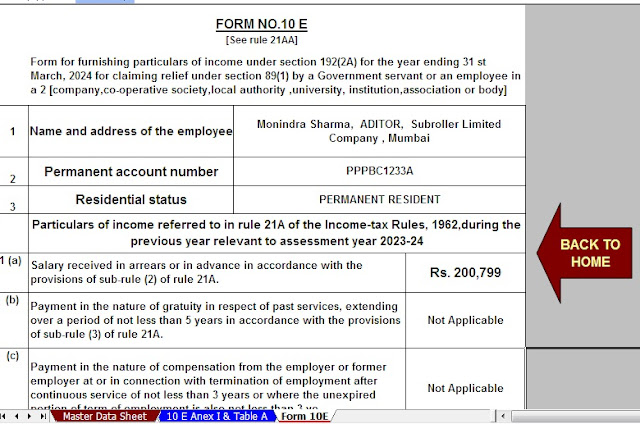

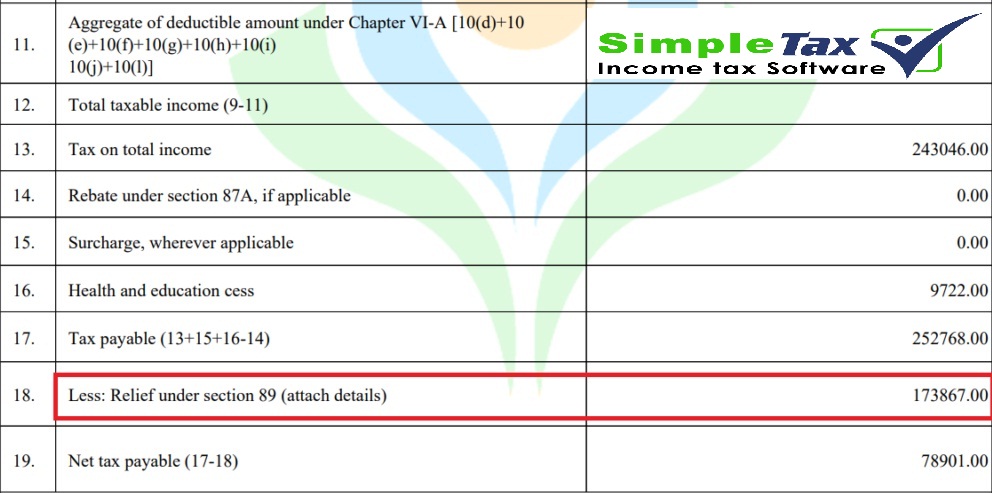

Download Automated Income Tax Arrears Relief Calculator U/s89 (1) with Form 10E from the F.Y.2000-01 to F.Y.2022-23(Updated Version)