[ad_1]

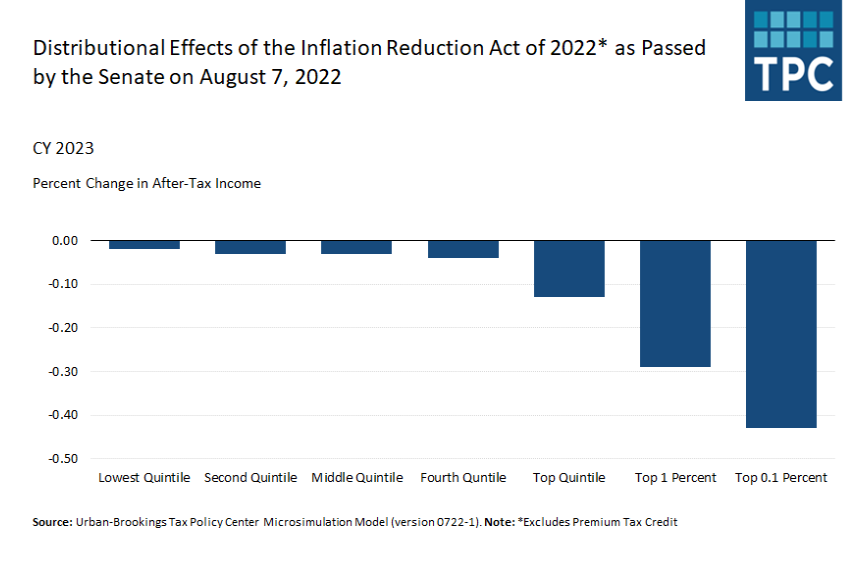

one in new analysisThe Tax Policy Center found that the tax provisions of the Inflation Reduction Act (IRA) are highly progressive. Taxes will increase by $6,060 (0.3 percent of after-tax income) in 2023 for the top 1 percent of households with incomes over nearly $1 million. The TPC estimates that the top 0.1 percent (income over $4.4 million) of households will have an additional burden of $41,580 (0.4 percent of after-tax income).

IRAs include a mix of tax deductions and tax increases that are included in TPC’s analysis. Most of the revenue is generated by corporate minimum tax And this tax on stock buyback, as well as the extension of the limit on additional business losses to non-corporate taxpayers. the bill will also apply multiple clean energy tax breaks For businesses and individuals. TPC’s analysis does not include the potential benefits of drug pricing reform or other spending provisions.

The TPC’s primary analysis also does not include a provision for the bill that would extend to three-year Enhanced Premium Tax Credit (PTC) for Affordable Care Act (ACA) insurance plans. However, we only prepared a supplementary table for 2023 Includes PTC with other tax provisions of an IRA,

Historically, the TPC has treated PTC as an expense program and generally excluded it from tax analysis. For example, analysis of TPC’s Build Back Better and 2016 presidential candidate tax plans does not include PTC provisions. TPC partnered with Urban Institute Health Policy Center to incorporate PTC in delivery analyzes,

Without including PTC, the lowest quintile would experience a negligible impact, while medium-quintile taxpayers would have an average tax burden of $20, less than .05 percent of their income. (Taxpayers in the lowest quintile have incomes less than $30,500 and those in the middle income group have incomes between $60,000 and $106,000.)

Over time, the change in the tax burden of provisions as measured by our model decreases, as benefits from green subsidies increase. By 2031, the bottom three quintiles will see a fall in the tax burden, equivalent to 0.1 per cent of post-tax income. For the top 1 percent, their increase in tax burden would drop somewhat to an average of $3,240 (about 0.1 percent of after-tax income). For the top 0.1 percent, their average increase in tax burden would be $22,510 (0.2 percent of after-tax income).

additional perspective

On the campaign trail and since taking office, President Biden has pledged not to raise taxes on those earning less than $400,000. The administration says its promise applies only to taxes that people pay directly.

Looking at only those direct taxes, such as personal income taxes and payroll taxes, IRAs are based on the three-year TPC model (2023, 2027And 2031) The only exception: Taxpayers in the top 1 percent in 2027 who will pay more because the bill increases the pass-through business loss limit from 2026 to 2028. Under the broader view of tax incidence, households earning less than $400,000 would have to bear some. Corporate tax burden through lower wages or lower returns in stock ownership, especially in retirement accounts, even if they don’t pay much in direct taxes.

Much of the disagreement reflects a long-standing debate among economists and others over the burden of increasing corporate taxes on capital and labor. The TPC—like the Joint Committee on Taxation, Treasury, and the Congressional Budget Office—allocates the burden of a corporate tax increase between those receiving investment income and workers, although allocation shares vary slightly between the three organizations. Capital income recipients bear the heaviest burden among them all.

The relatively modest increase in the tax burden from corporate tax changes for some low- and middle-income households will be fully offset in 2023 by the increased premium tax credit, as well as clean energy subsidies, and will be fully offset in subsequent years. Will go energy subsidy.

In the past, the TPC has created tables estimating the number of households in each income group that will pay more or less in tax. The types of tax provisions in this bill make it challenging to present accurate estimates and those tables are not included in the IRA’s analysis of the TPC. joint committee on taxation Recently such an analysis has been done.

Still, as the TPC shows, the additional tax burden from IRAs will be progressive, falling mostly on the top 1 percent of taxpayers.

[ad_2]

Source link